Your Can you use dependent care fsa for summer camp ideas are available. Can you use dependent care fsa for summer camp are a photo that is most popular and liked by everyone now. You can Download the Can you use dependent care fsa for summer camp files here. Download all royalty-free wallpaper.

If you’re searching for can you use dependent care fsa for summer camp pictures information linked to the can you use dependent care fsa for summer camp topic, you have visit the right blog. Our site frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

Can You Use Dependent Care Fsa For Summer Camp. Your Dependent Care FSA can be used to cover care costs for children between the ages 0-12. The IRS determines which expenses can be reimbursed by an FSA. Cover more than you think. The IRS allows a DCAP to be used for children up to age 13 or other dependents who may not be able to care for themselves.

How To Set Up A Dependent Care Fsa From policygenius.com

How To Set Up A Dependent Care Fsa From policygenius.com

An FSA for dependent care can be used to cover costs for day care preschool before- and aftercare or summer camps. They must also be claimed as dependents on the federal income tax return. However expenses for before- andor after-school care of a child in kindergarten or higher grade can be considered child care. The money has to be used on. Essentially you can also claim a credit somewhere between 20-35 of 3K per kid or 6K per household as a credit for dependent care expenses. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services.

Essentially you can also claim a credit somewhere between 20-35 of 3K per kid or 6K per household as a credit for dependent care expenses.

Under IRS guidelines you can send a child to a day camp as a work-related expense with a Dependent Care FSA. Under IRS guidelines you can send a child to a day camp as a work-related expense with a dependent care FSA DCFSA. The usage of the Dependent Care FSA decreases the amount you can utilize for the credit by the contribution amount. However expenses for before- andor after-school care of a child in kindergarten or higher grade can be considered child care. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of up to 35 percent of qualifying expenses of 3000 1050 for one child or dependent or up to 6000 2100 for two or more children or dependents for tax year 2020 but under the American Rescue Plan the credit for child care will be increased for tax year 2021 only the taxes you.

Source: investopedia.com

Source: investopedia.com

It is a qualified expense. We dont spend a lot of time covering dependent care FSAs on these pages but summer is always a good time to see if this type of account is right for your family. Use DCFSA dollars to cover a wide variety of eligible dependent care expenses3 including. To use a Dependent Care FSA for reimbursement on day camp children have to be younger than 13 years old. If you elected to save some money in a Flexible Spending Account FSA through your employer you may be surprised to know that you can use that fund for certain types of summer camp.

Source: ro.pinterest.com

Source: ro.pinterest.com

Under IRS guidelines you can send a child to a day camp as a work-related expense with a Dependent Care FSA. FSA accounts let employees use pre-tax dollars to pay for. Summer Camps Day Camps are eligible for reimbursement with a dependent care flexible spending account DCFSA. The IRS determines which expenses can be reimbursed by an FSA. While this list shows the eligibility of some of the most common dependent care expenses its not meant to be comprehensive.

Source: hisawyer.com

Source: hisawyer.com

FSA accounts let employees use pre-tax dollars to pay for. It is a qualified expense. Cover more than you think. Use DCFSA dollars to cover a wide variety of eligible dependent care expenses3 including. Summer camp is not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA or a limited care flexible spending account LCFSA.

Source: vitacompanies.com

Source: vitacompanies.com

Summer camp is not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA or a limited care flexible spending account LCFSA. Cover more than you think. We dont spend a lot of time covering dependent care FSAs on these pages but summer is always a good time to see if this type of account is right for your family. Employees can only use it for care while they work or go to school. Under IRS guidelines you can send a child to a day camp as a work-related expense with a Dependent Care FSA.

Source: livelyme.com

Source: livelyme.com

1FSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Ive used my FSA for spring and winter break camps and we use much of my FSA for summer camps every year. The IRS allows a DCAP to be used for children up to age 13 or other dependents who may not be able to care for themselves. They must also be claimed as dependents on the federal income tax return. Yes it can.

Source: in.pinterest.com

Source: in.pinterest.com

It is a qualified expense. Summer Camps Day Camps are eligible for reimbursement with a dependent care flexible spending account DCFSA. Cover more than you think. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Your Dependent Care FSA can be used to cover care costs for children between the ages 0-12.

Source: pinterest.com

Source: pinterest.com

The usage of the Dependent Care FSA decreases the amount you can utilize for the credit by the contribution amount. The IRS determines which expenses can be reimbursed by an FSA. If you elected to save some money in a Flexible Spending Account FSA through your employer you may be surprised to know that you can use that fund for certain types of summer camp. The benefit account cannot be used for expenses like babysitting for a. This applies even if the camp specializes in sports ie.

Source: healthaccounts.bankofamerica.com

Source: healthaccounts.bankofamerica.com

Under IRS guidelines you can send a child to a day camp as a work-related expense with a Dependent Care FSA. The IRS allows a DCAP to be used for children up to age 13 or other dependents who may not be able to care for themselves. An FSA for dependent care can be used to cover costs for day care preschool before- and aftercare or summer camps. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Dependent Care FSA and Summer Camp This summer use your DCFSA to pay for day camps that your child attends.

Source: policygenius.com

Source: policygenius.com

If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of up to 35 percent of qualifying expenses of 3000 1050 for one child or dependent or up to 6000 2100 for two or more children or dependents for tax year 2020 but under the American Rescue Plan the credit for child care will be increased for tax year 2021 only the taxes you. Ive used my FSA for spring and winter break camps and we use much of my FSA for summer camps every year. Use DCFSA dollars to cover a wide variety of eligible dependent care expenses3 including. Your Dependent Care FSA can be used to cover care costs for children between the ages 0-12. What is summer camp.

Source: pinterest.com

Source: pinterest.com

The usage of the Dependent Care FSA decreases the amount you can utilize for the credit by the contribution amount. However if you are paying for an overnight summer camp then this expense would not qualify. The benefit account cannot be used for expenses like babysitting for a. Day camp expenses are eligible for reimbursement from a Dependent Care FSA as long as they provide custodial care for children under the age of 13 so the parent s can work look for work or attend school full-time. However expenses for before- andor after-school care of a child in kindergarten or higher grade can be considered child care.

![]() Source: fsastore.com

Source: fsastore.com

However expenses for before- andor after-school care of a child in kindergarten or higher grade can be considered child care. What is summer camp. Under IRS guidelines you can send a child to a day camp as a work-related expense with a Dependent Care FSA. 1FSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Essentially you can also claim a credit somewhere between 20-35 of 3K per kid or 6K per household as a credit for dependent care expenses.

Source: fsastore.com

Source: fsastore.com

Essentially you can also claim a credit somewhere between 20-35 of 3K per kid or 6K per household as a credit for dependent care expenses. Depending on the arrangements they may be entitled to claim a healthy tax credit the dependent care credit also known as the child care credit for. We dont spend a lot of time covering dependent care FSAs on these pages but summer is always a good time to see if this type of account is right for your family. Dependent Care FSA and Summer Camp This summer use your DCFSA to pay for day camps that your child attends. To use a Dependent Care FSA for reimbursement on day camp children have to be younger than 13 years old.

Source: pinterest.com

Source: pinterest.com

We dont spend a lot of time covering dependent care FSAs on these pages but summer is always a good time to see if this type of account is right for your family. Employees can only use it for care while they work or go to school. Dependent Care FSA and Summer Camp This summer use your DCFSA to pay for day camps that your child attends. Ive used my FSA for spring and winter break camps and we use much of my FSA for summer camps every year. The benefit account cannot be used for expenses like babysitting for a.

Source: pinterest.com

Source: pinterest.com

Under IRS guidelines you can send a child to a day camp as a work-related expense with a dependent care FSA DCFSA. Our extended day only costs about 3Kyear Youd need a receipt from the camp that lists their Tax ID EIN number the dates covered the full name and address and the dependents name I think. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. Employees can only use it for care while they work or go to school. Use DCFSA dollars to cover a wide variety of eligible dependent care expenses3 including.

Source: benefitresource.com

Source: benefitresource.com

Depending on the arrangements they may be entitled to claim a healthy tax credit the dependent care credit also known as the child care credit for. Yes it can. FSA accounts let employees use pre-tax dollars to pay for. The usage of the Dependent Care FSA decreases the amount you can utilize for the credit by the contribution amount. If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of up to 35 percent of qualifying expenses of 3000 1050 for one child or dependent or up to 6000 2100 for two or more children or dependents for tax year 2020 but under the American Rescue Plan the credit for child care will be increased for tax year 2021 only the taxes you.

Source: realsimple.com

Source: realsimple.com

The IRS allows a DCAP to be used for children up to age 13 or other dependents who may not be able to care for themselves. To use a Dependent Care FSA for reimbursement on day camp children have to be younger than 13 years old. Daycare nursery school and preschool. 1FSAs are never taxed at a federal income tax level when used appropriately for qualified medical expenses. Yes it can.

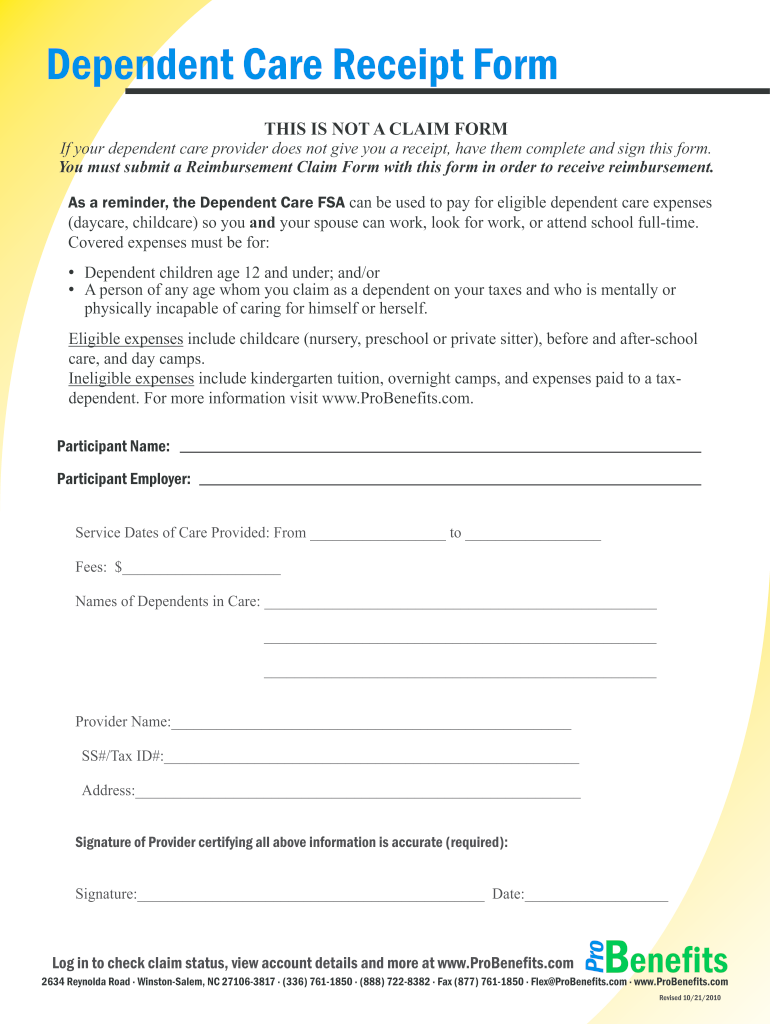

Source: dependent-care-receipt-form.pdffiller.com

Source: dependent-care-receipt-form.pdffiller.com

To use a Dependent Care FSA for reimbursement on day camp children have to be younger than 13 years old. If you are sending your child to a summer day camp then you can use the money from the FSA dependent care account for this. An FSA for dependent care can be used to cover costs for day care preschool before- and aftercare or summer camps. The IRS allows a DCAP to be used for children up to age 13 or other dependents who may not be able to care for themselves. Before or afterschool programs.

Source: washingtonpost.com

Source: washingtonpost.com

The money has to be used on. To use a Dependent Care FSA for reimbursement on day camp children have to be younger than 13 years old. The money has to be used on. Your Dependent Care FSA can be used to cover care costs for children between the ages 0-12. Summer camp is not eligible for reimbursement with a flexible spending account FSA health savings account HSA health reimbursement arrangement HRA or a limited care flexible spending account LCFSA.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you use dependent care fsa for summer camp by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.