Your Can you claim summer camp on your taxes canada wallpaper are ready in this website. Can you claim summer camp on your taxes canada are a pictures that is most popular and liked by everyone today. You can Get the Can you claim summer camp on your taxes canada files here. Find and Download all royalty-free pictures.

If you’re searching for can you claim summer camp on your taxes canada pictures information linked to the can you claim summer camp on your taxes canada keyword, you have pay a visit to the ideal blog. Our site always provides you with hints for viewing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

Can You Claim Summer Camp On Your Taxes Canada. Completing your tax return. You can claim a refundable tax credit for the physical activities or artistic cultural or recreational activities of an eligible child provided you meet all of the following conditions. Questions and answers about child care expenses. Up to 35 of qualifying expenses of 3000 1050 for one child or dependent or.

Minister Of Digital Government Briefing Book Canadian Digital Service Cds Canada Ca From canada.ca

Minister Of Digital Government Briefing Book Canadian Digital Service Cds Canada Ca From canada.ca

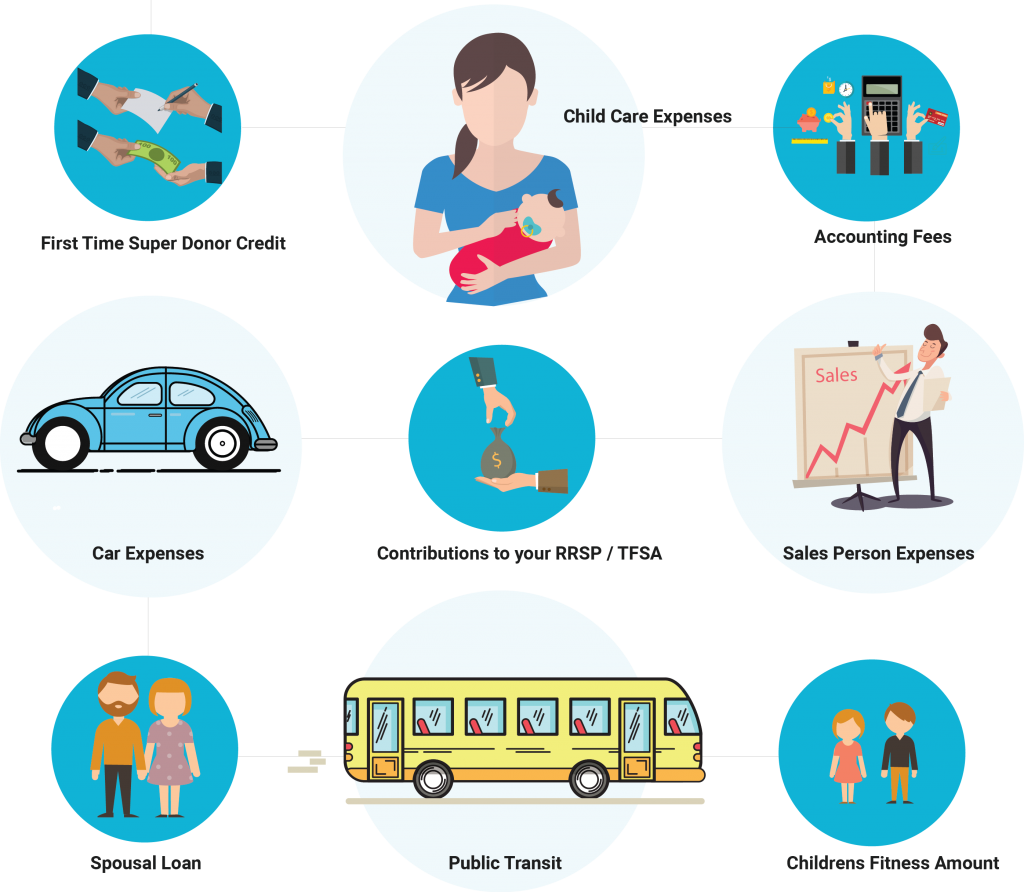

Tax relief if applicable can come in one of two forms. Boarding schools overnight sports schools or camps where lodging is involved read the note in Part A of Form T778 Child Care Expenses Deduction for 2020 If you were a resident of Quebec you can also claim the basic contribution you paid directly to the subsidized childcare service provider. There are numerous tax credits in Canada that apply to summer camps and private schools. Information about child care services receipts and more. For tax purposes expenses that you pay for summer camp must be for a child considered a. The long-standing child-care deduction or the relatively new childrens fitness tax credit.

If applicable also claim the additional contribution calculated on Revenu Québec s Schedule I Additional.

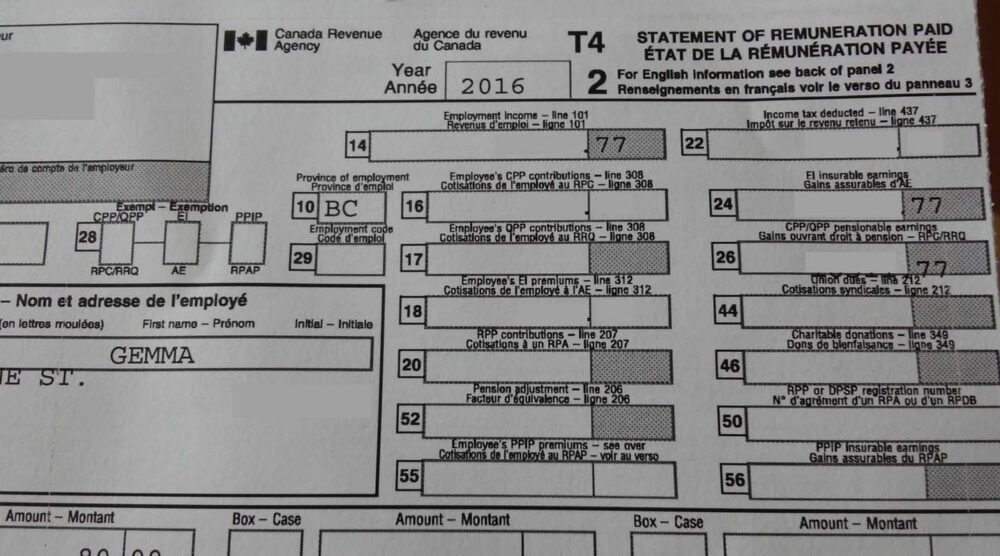

After your experience of working at a camp in Canada youll have received a paycheck and may have noticed some deductions on your earnings. Tax relief if applicable can come in one of two forms. As a foreign worker in Canada you do pay some taxes totalling about 5-7 of your salary that you are not eligible to claim back. The training and education facilities used. Summer day camps however qualify for the Child and Dependent Care Credit as long as your child is under the age of 13 at the end of the tax year no age limit if they are disabled and you are sending your child to camp so you can work. If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit on your 2020 taxes of.

Source: turbotax.intuit.ca

Source: turbotax.intuit.ca

Tax relief if applicable can come in one of two forms. Can you claim summer camp expenses for the dependent care credit. What payments can you not claim. Here are six facts to help you determine whether your childs summer camp expenses qualify for a tax credit. The tax credit finalized last January applies to eligible amounts of up to 50000 per child for any child under the.

Source: thesuburban.com

Source: thesuburban.com

The long-standing child-care deduction or the relatively new childrens fitness tax credit. Up to 35 of qualifying expenses of 3000 1050 for one child or dependent or. The training and education facilities used. Last year 2007 the Childrens Fitness tax Credit was put into place by the federal government. Summer camps for children typically align well with CRAs criteria including camps that provide overnight lodging.

Source: offtracktravel.ca

Source: offtracktravel.ca

Up to 6000 2100 for two or more children or dependents. What payments can you not claim. Information about child care services receipts and more. 200 per week for a child under 7. Thankfully the Canada Revenue Agency CRA has some tax breaks available that may help take the sting out of summer time bills.

Source: turbotax.intuit.ca

Source: turbotax.intuit.ca

Summer day camps however qualify for the Child and Dependent Care Credit as long as your child is under the age of 13 at the end of the tax year no age limit if they are disabled and you are sending your child to camp so you can work. The long-standing child-care deduction or the relatively new childrens fitness tax credit. As a foreign worker in Canada you do pay some taxes totalling about 5-7 of your salary that you are not eligible to claim back. The child must be younger than 13 years old. Tax relief if applicable can come in one of two forms.

Source: madanca.com

Source: madanca.com

There are numerous tax credits in Canada that apply to summer camps and private schools. Unless youre sending your child ren off to sleepover camp the day after school ends you are likely looking for activities to keep them busy. There are numerous tax credits in Canada that apply to summer camps and private schools. If the provider happens to be your own child he. The long-standing child-care deduction or the relatively new childrens fitness tax credit.

Source: offtracktravel.ca

Source: offtracktravel.ca

Expenses for meals provided by a daycare service or camp if these expenses are included in the cost of the services and are not billed separately expenses paid to a boarding school or a camp up to a maximum of. But whether you can claim some tax relief for camp fees – and how much you can get – may depend on the type of camp it is. 200 per week for a child under 7. Boarding schools overnight sports schools or camps where lodging is involved read the note in Part A of Form T778 Child Care Expenses Deduction for 2020 If you were a resident of Quebec you can also claim the basic contribution you paid directly to the subsidized childcare service provider. Can you claim summer camp expenses for the dependent care credit.

Source: narcity.com

Source: narcity.com

The training and education facilities used. If applicable also claim the additional contribution calculated on Revenu Québec s Schedule I Additional. Questions and answers about child care expenses. After your experience of working at a camp in Canada youll have received a paycheck and may have noticed some deductions on your earnings. Boarding schools overnight sports schools or camps where lodging is involved read the note in Part A of Form T778 Child Care Expenses Deduction for 2020 If you were a resident of Quebec you can also claim the basic contribution you paid directly to the subsidized childcare service provider.

Source: offtracktravel.ca

Source: offtracktravel.ca

But whether you can claim some tax relief for camp fees – and how much you can get – may depend on the type of camp it is. Up to 35 of qualifying expenses of 3000 1050 for one child or dependent or. 200 per week for a child under 7. You can claim a refundable tax credit for the physical activities or artistic cultural or recreational activities of an eligible child provided you meet all of the following conditions. Last year 2007 the Childrens Fitness tax Credit was put into place by the federal government.

Source: offtracktravel.ca

Source: offtracktravel.ca

Can you claim summer camp expenses for the dependent care credit. In many cases the answer is yes. Summer day camps however qualify for the Child and Dependent Care Credit as long as your child is under the age of 13 at the end of the tax year no age limit if they are disabled and you are sending your child to camp so you can work. The tax credit finalized last January applies to eligible amounts of up to 50000 per child for any child under the. What payments can you not claim.

Source: go.truenorthaccounting.com

Source: go.truenorthaccounting.com

After your experience of working at a camp in Canada youll have received a paycheck and may have noticed some deductions on your earnings. For tax purposes expenses that you pay for summer camp must be for a child considered a. The child must be younger than 13 years old. Thankfully the Canada Revenue Agency CRA has some tax breaks available that may help take the sting out of summer time bills. However the childcare expense deduction cannot be used for all expenses that may have been eligible under the fitness and arts credits.

Source: birchwoodcredit.com

Source: birchwoodcredit.com

For tax purposes expenses that you pay for summer camp must be for a child considered a. The credit has a maximum of 3000 for a. But whether you can claim some tax relief for camp fees – and how much you can get – may depend on the type of camp it is. Information about medical or hospital care educational expenses reimbursements and more. After your experience of working at a camp in Canada youll have received a paycheck and may have noticed some deductions on your earnings.

Source: issuu.com

Source: issuu.com

In many cases the answer is yes. Register the child in a program that is not part of a schools curriculum and that includes. You will need to attach Form 2441 to your tax return to claim the credit. The child must be younger than 13 years old. You were resident in Québec on December 31 2020.

Source: offtracktravel.ca

Source: offtracktravel.ca

But whether you can claim some tax relief for camp fees – and how much you can get – may depend on the type of camp it is. Find out how to calculate your allowable child care expenses deduction. Last year 2007 the Childrens Fitness tax Credit was put into place by the federal government. The credit has a maximum of 3000 for a. The long-standing child-care deduction or the relatively new childrens fitness tax credit.

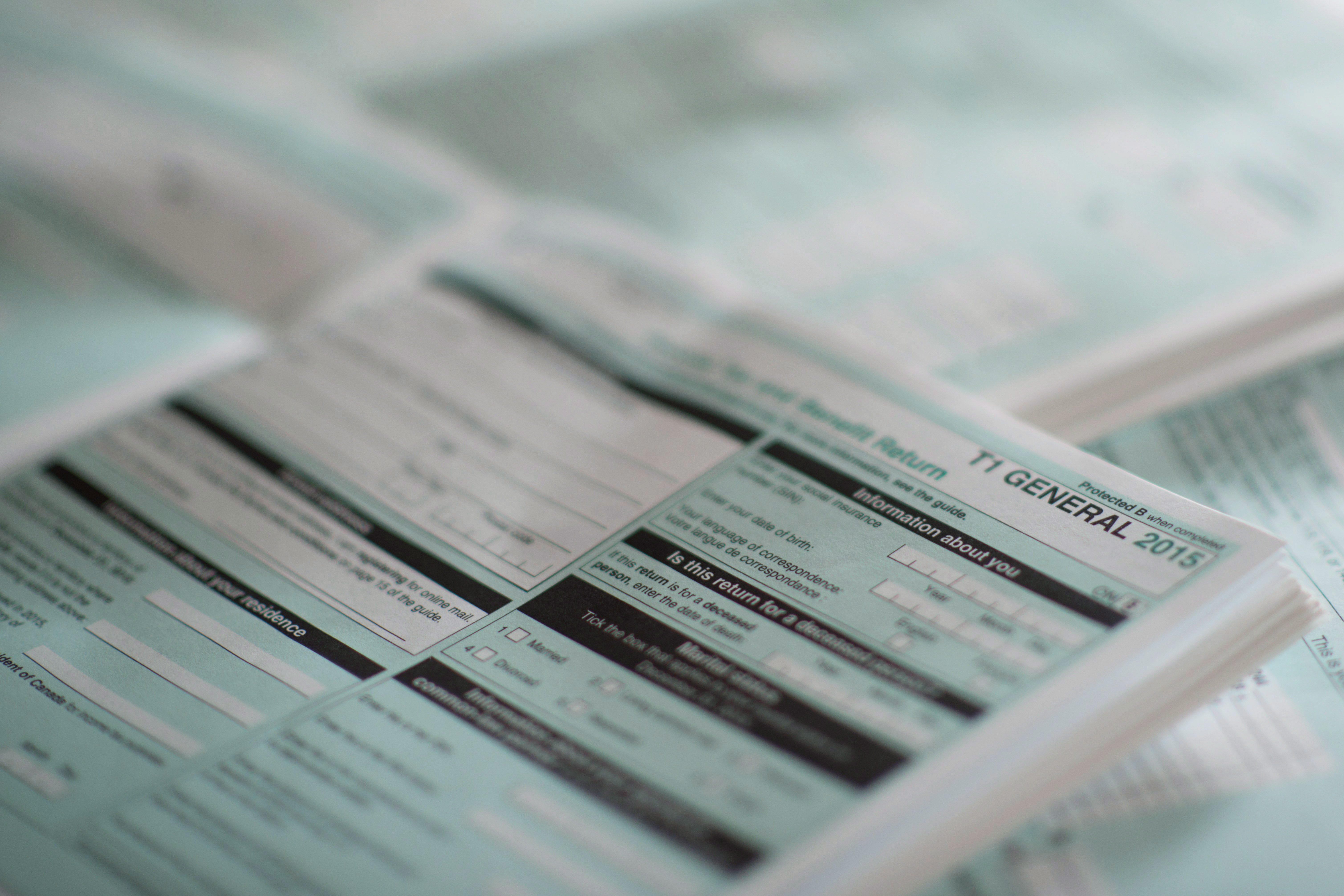

Source: canada.ca

Source: canada.ca

For tax purposes expenses that you pay for summer camp must be for a child considered a. Information about medical or hospital care educational expenses reimbursements and more. The credit has a maximum of 3000 for a. Be sure to get the camps information official name address and tax ID number for next years tax return before the camp ends. In 2020 you or your spouse on December 31 2020 paid to either.

Source: pinterest.com

Source: pinterest.com

As much as Id love for you to you cant pay for my kids to go to camp and claim the credit. For tax purposes expenses that you pay for summer camp must be for a child considered a. If your child meets certain requirements there is nothing in the tax code that says you have to find the least expensive day care in order to claim the dependent care credit and summer camps are often just another form of day care. If the provider happens to be your own child he. Summer camps for children typically align well with CRAs criteria including camps that provide overnight lodging.

Source: canada.ca

Source: canada.ca

Information about child care services receipts and more. As a foreign worker in Canada you do pay some taxes totalling about 5-7 of your salary that you are not eligible to claim back. You can claim a refundable tax credit for the physical activities or artistic cultural or recreational activities of an eligible child provided you meet all of the following conditions. Can you claim summer camp expenses for the dependent care credit. After your experience of working at a camp in Canada youll have received a paycheck and may have noticed some deductions on your earnings.

Source: globalnews.ca

Source: globalnews.ca

If applicable also claim the additional contribution calculated on Revenu Québec s Schedule I Additional. If your child meets certain requirements there is nothing in the tax code that says you have to find the least expensive day care in order to claim the dependent care credit and summer camps are often just another form of day care. As a foreign worker in Canada you do pay some taxes totalling about 5-7 of your salary that you are not eligible to claim back. Last year 2007 the Childrens Fitness tax Credit was put into place by the federal government. The credit has a maximum of 3000 for a.

Source: huffingtonpost.ca

Source: huffingtonpost.ca

If your child meets certain requirements there is nothing in the tax code that says you have to find the least expensive day care in order to claim the dependent care credit and summer camps are often just another form of day care. After your experience of working at a camp in Canada youll have received a paycheck and may have noticed some deductions on your earnings. If the provider happens to be your own child he. The long-standing child-care deduction or the relatively new childrens fitness tax credit. Register the child in a program that is not part of a schools curriculum and that includes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you claim summer camp on your taxes canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.